CAPITAL ONE

Spend Tracker – A Financial Wellness Tool

Spend Tracker was a digital tool designed to help users understand their monthly spending, develop healthier financial habits, and ultimately reduce debt. Originally developed by Capital One Labs, the product needed a complete redesign to meet customer expectations and align with a broader company mission focused on financial well-being.

As the lead UX/UI designer, I collaborated closely with product and engineering to rethink, rebuild, and relaunch this experience from the ground up. We successfully launched the MVP to 10% of users and observed notable behavior changes in user engagement and financial activity.

Role: Lead UX/UI Designer

Platform: iOS & Android

Team: Product Manager, Product Owner, 3 Tech Teams (iOS, Android, Backend)

Key Skills: UX/UI Design, Research & User Testing, Product Strategy, Knowledge Mapping, Roadmap Development, and Production & Handoff

The Opportunity

Many Americans lack a clear picture of how they spend their money on a day-to-day basis. Whether thats due to a lack of motivation or lack of education, this disconnect often leads to overspending, debt accumulation, and poor financial decisions.

Spend Tracker set out to:

Create visibility into customers’ monthly spend

Provide actionable insights to encourage smarter financial decisions

Build habits that help users stay within budget and reduce debt

The original product had outdated architecture and an inconsistent user experience. A full redesign—both technically and visually—was required.

Customer Pain Points

Lack of awareness around spending patterns

Limited understanding of finances across credit cards

No clear budgeting or monthly reflection process

Tendency to overspend and fall into avoidable debt cycles

Business Context

The project supported a broader Capital One initiative to “Give every American confidence in their financial future and security in their financial present.” Spend Tracker was one of the first product experiments under a new business pillar focused on Financial Well-Being.

Success would not only improve customer ability to pay down debt and become more educated about their finances but position Capital One as a trusted partner in everyday financial tools.

Design Process

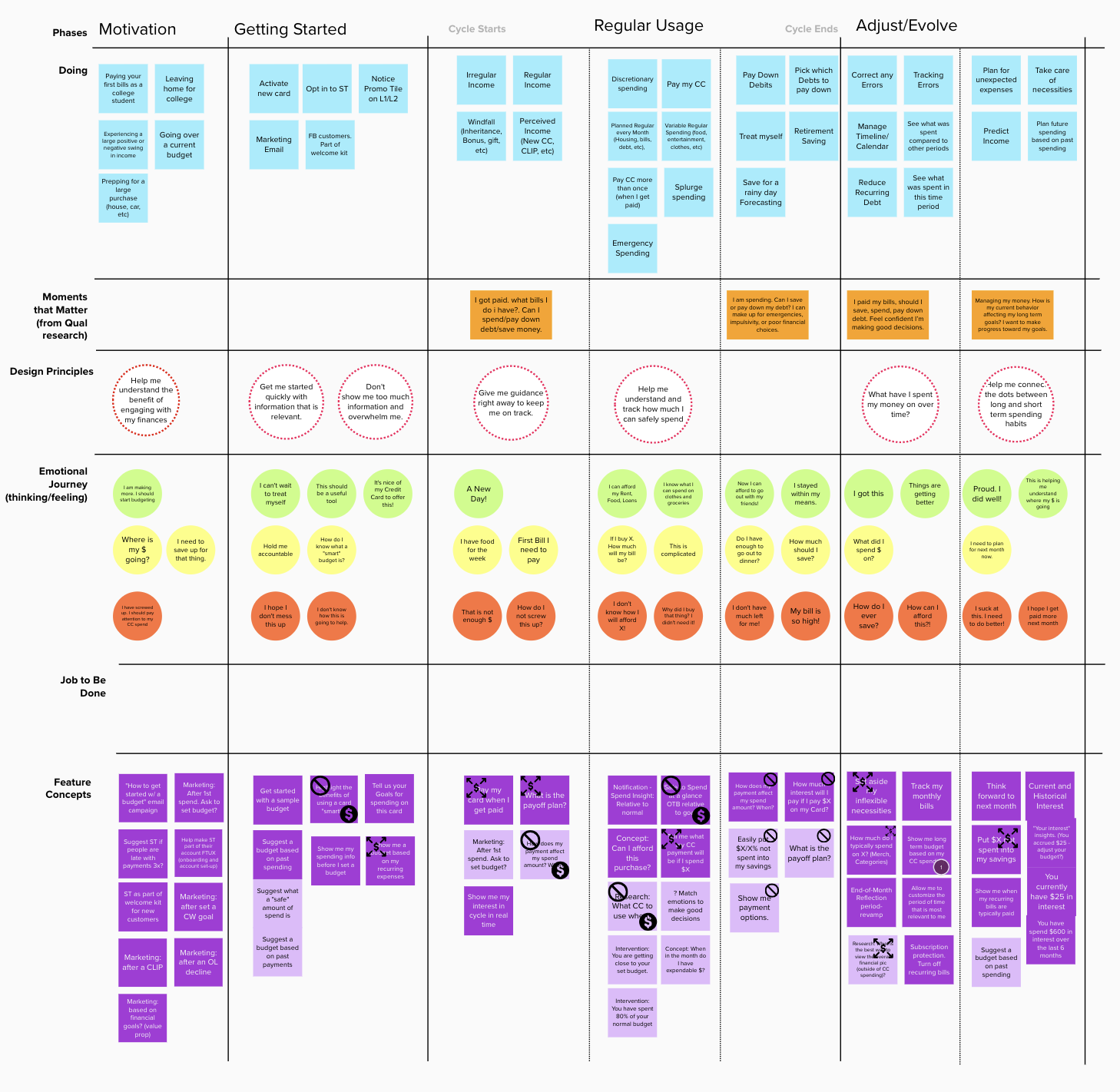

Discovery & Research

Mapped existing research and aligned on behavioral insights

Created a Customer Journey across five core phases:

Motivation – What triggers the desire to spend more mindfully?

Getting Started – How do customers decide on and set a budget?

Regular Usage – How do they track progress through the month?

Cycle Needs – What adjustments do they make mid-cycle?

Adjust & Evolve – How do they reflect and reset for the next month?

Knowledge Mapping & Ideation

Conducted brainstorming sessions with cross-functional partners

Identified opportunities for simplicity, habit-building, and behavioral nudges

Prioritized core features to focus on awareness, tracking, and reflection

User Testing

Developed and concept tested prototypes focused on:

A simpler onboarding experience (FTUX)

Historical spend and monthly summaries

Preferences for goal setting and notifications

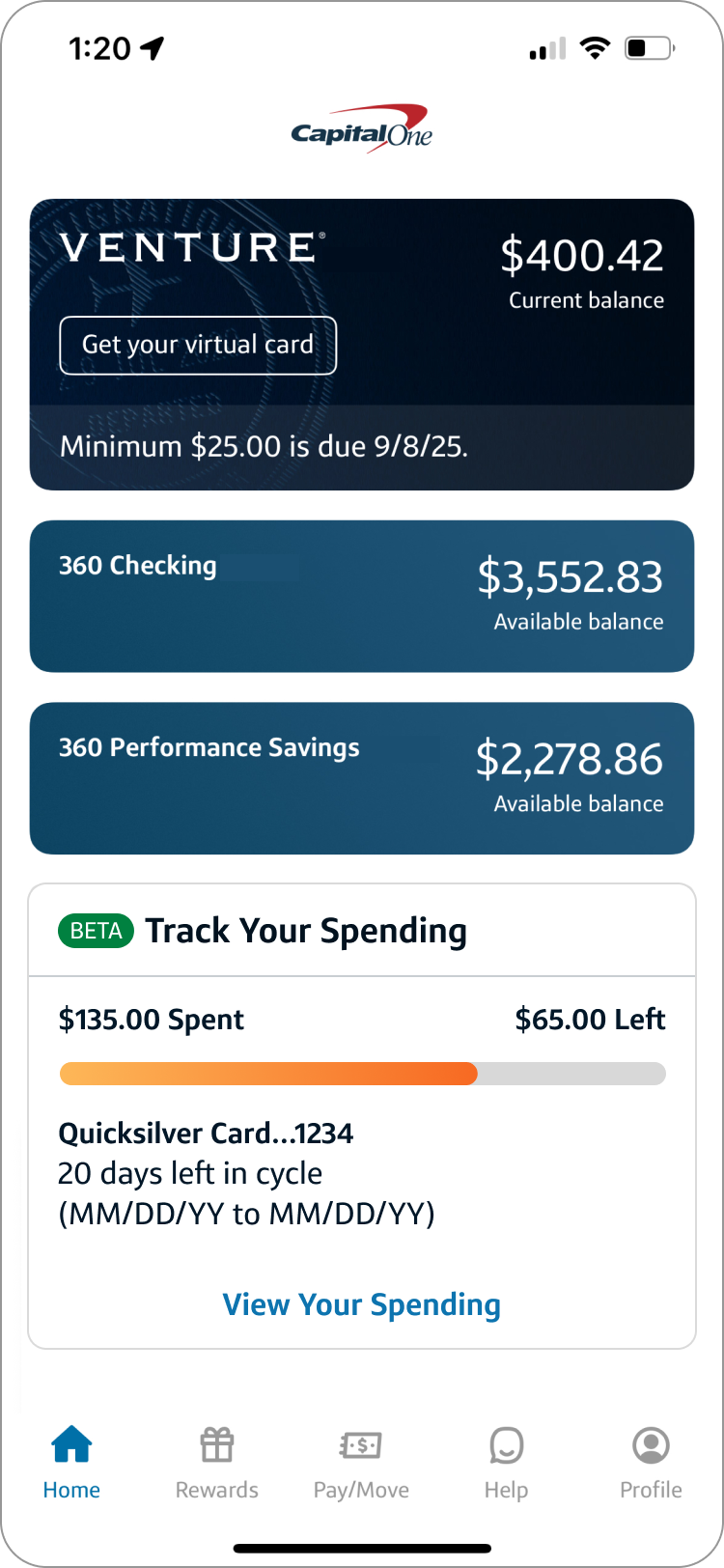

Design Solution

The final MVP included three key flows:

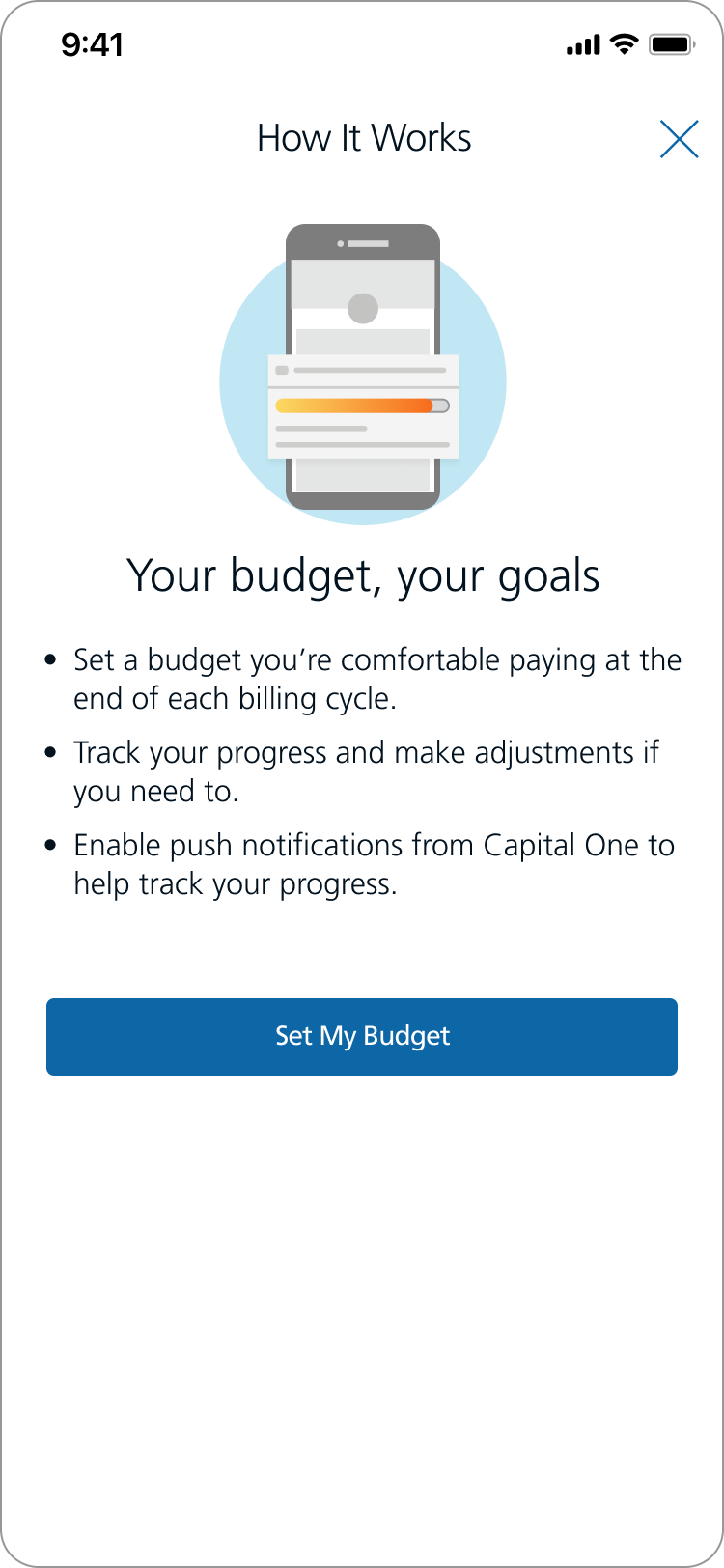

FTUX (First-Time User Experience)

Reduced onboarding from three screens to one

Clarified benefits and consolidated setup context

Redesigned illustration to align with existing Capital One brand

Reduced the need for two interaction styles to a single button

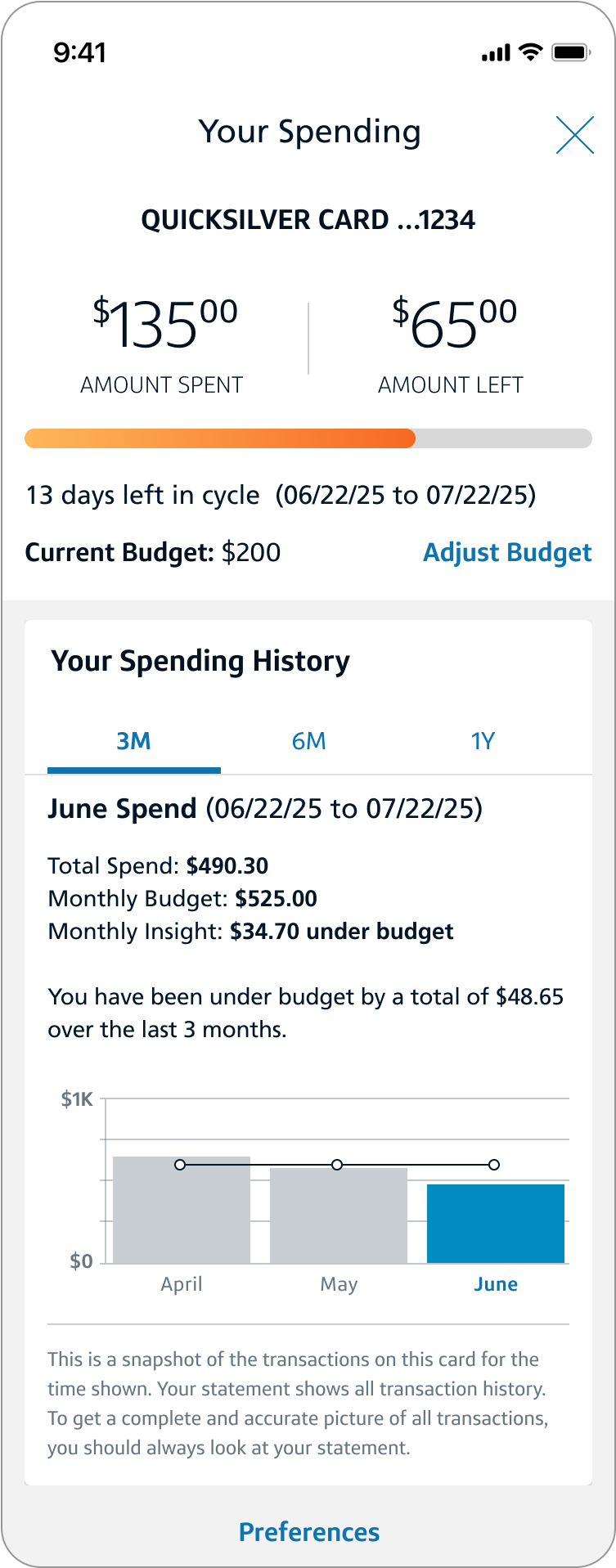

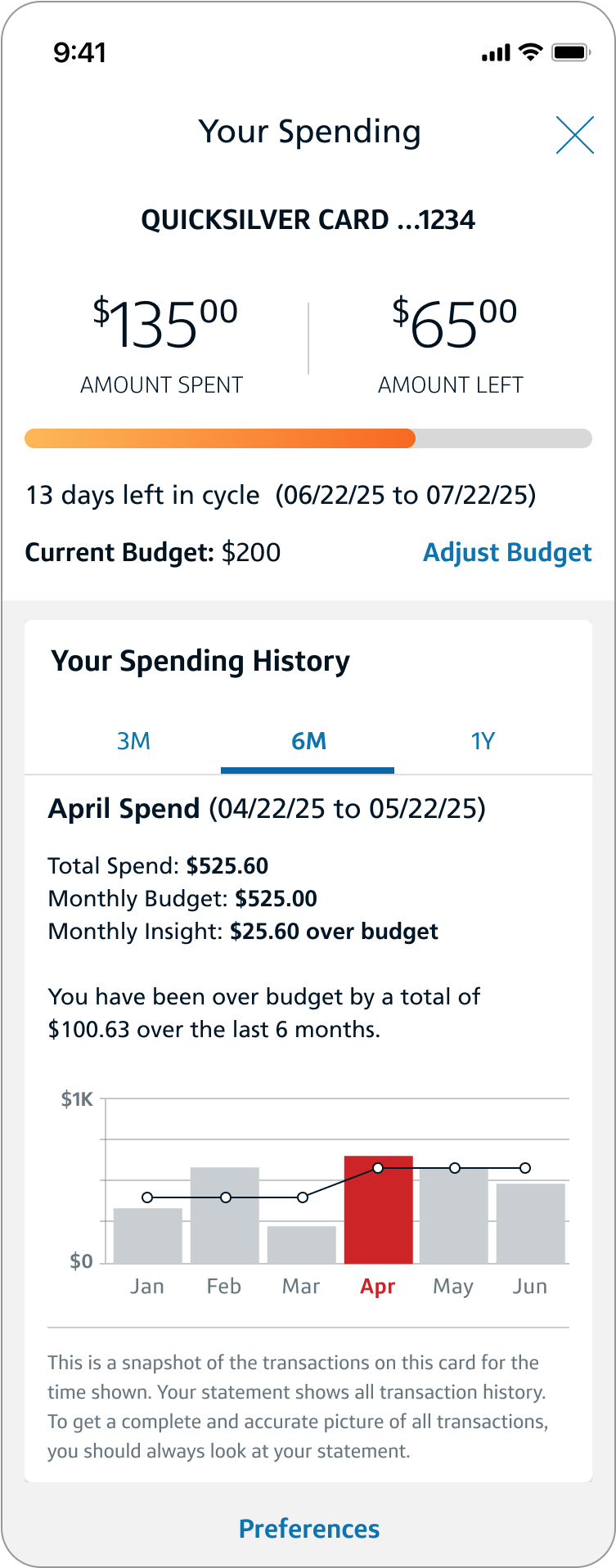

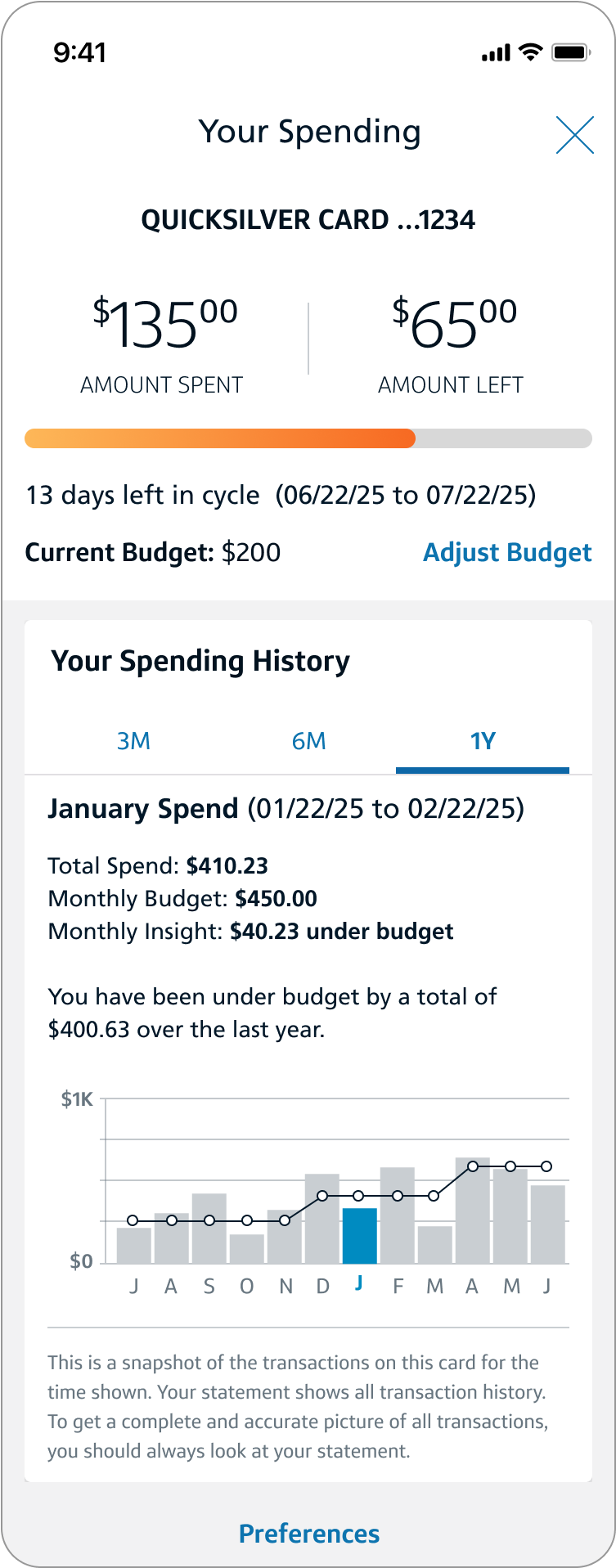

Spend Details & Historical Views

Offered real-time insight into current spending habits

Designed a new feature to showcase a users monthly spend data over 3 months, 6 months and 1 year

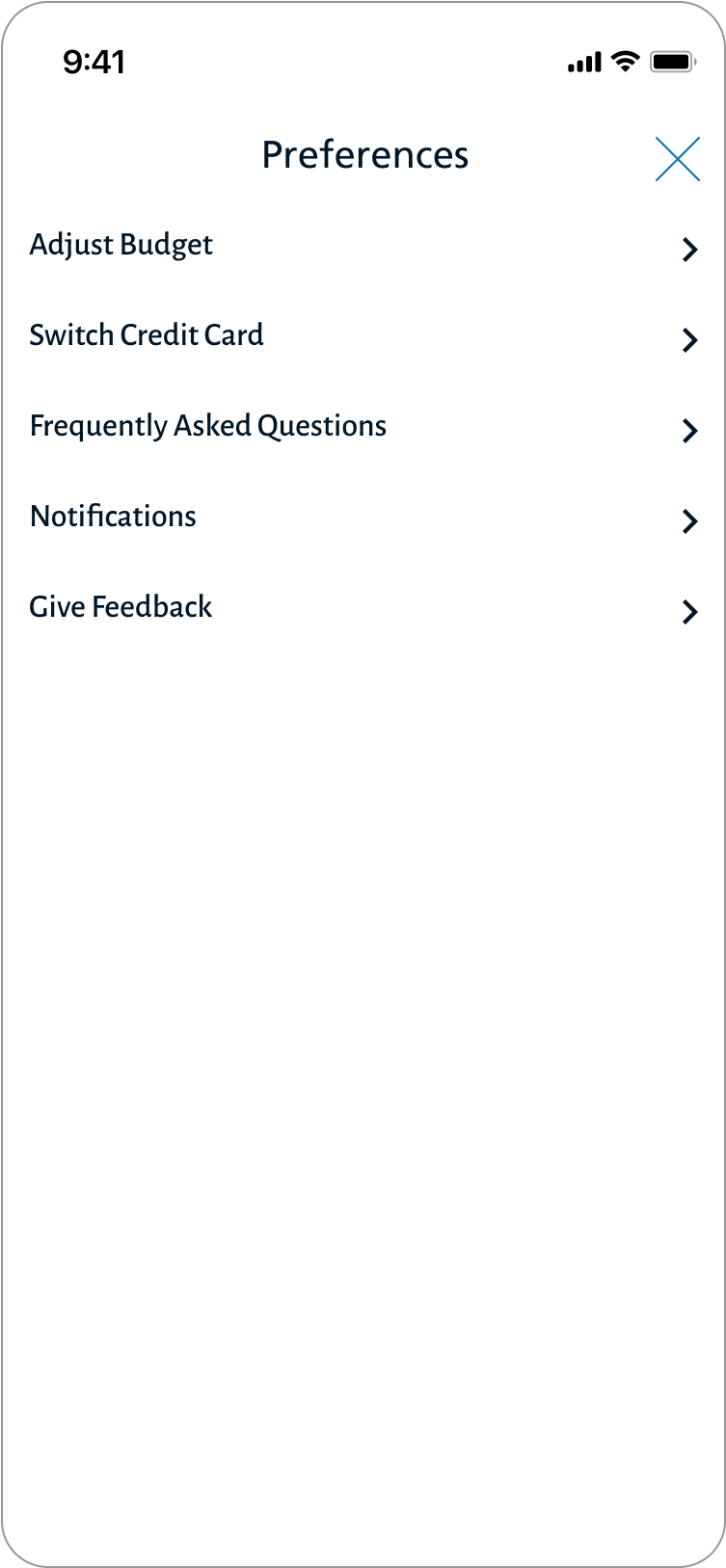

Grouped all setting and preferences into a single location

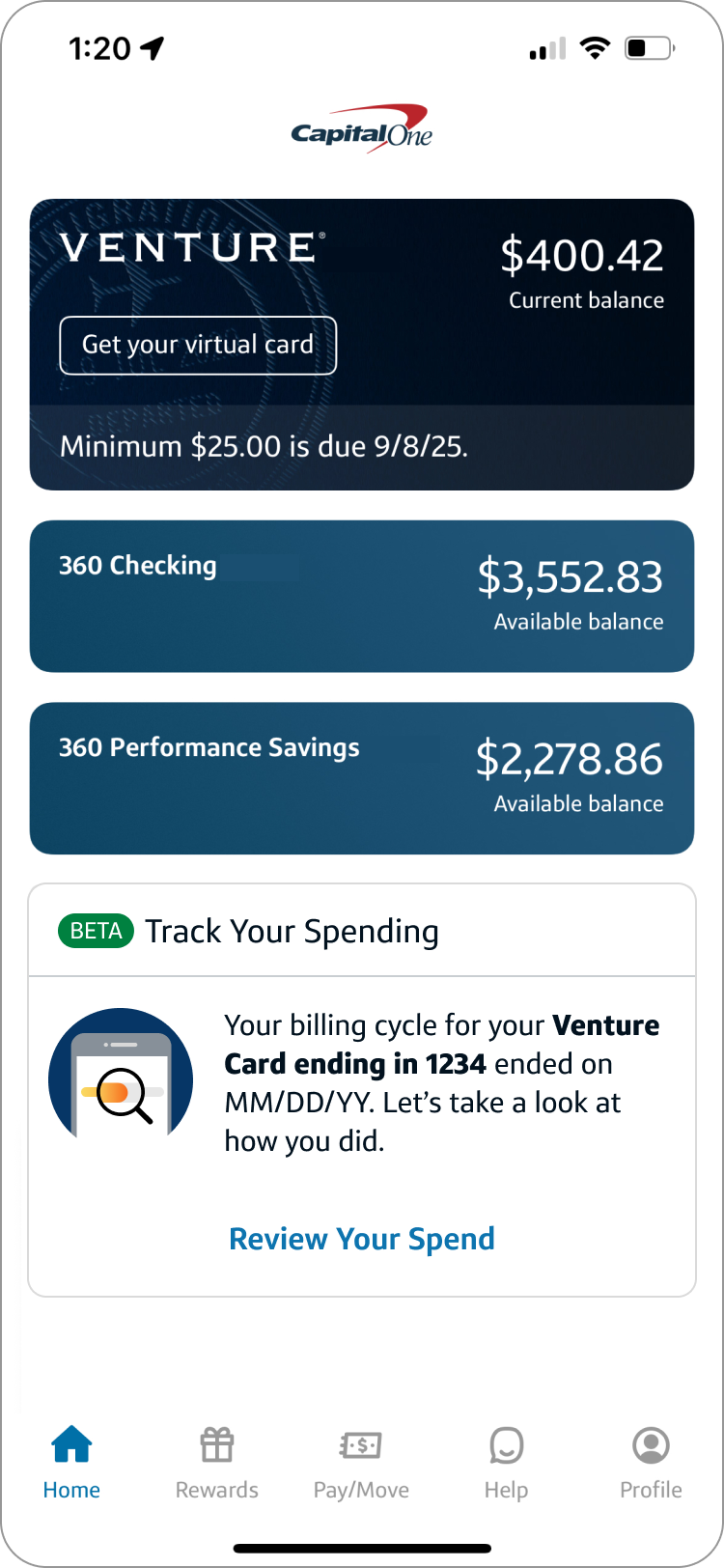

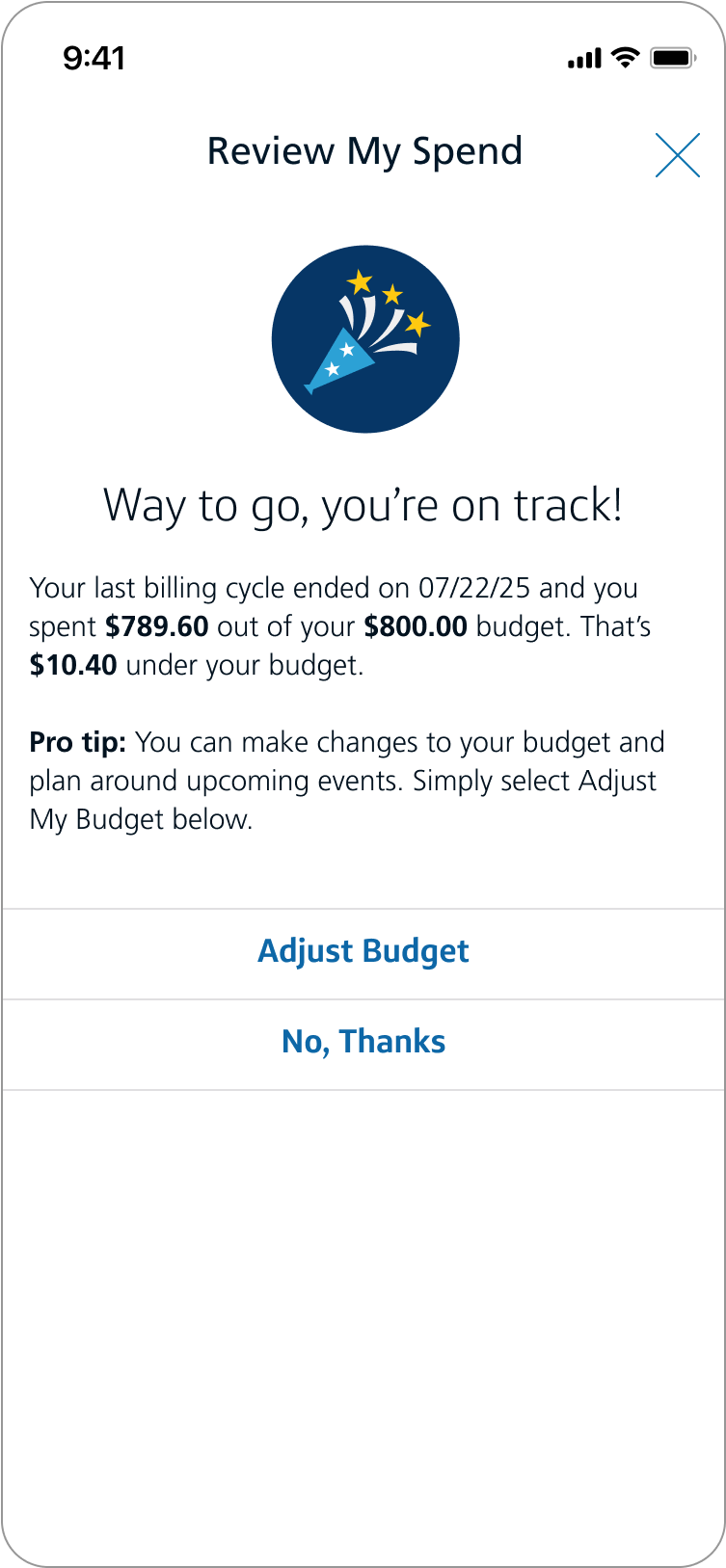

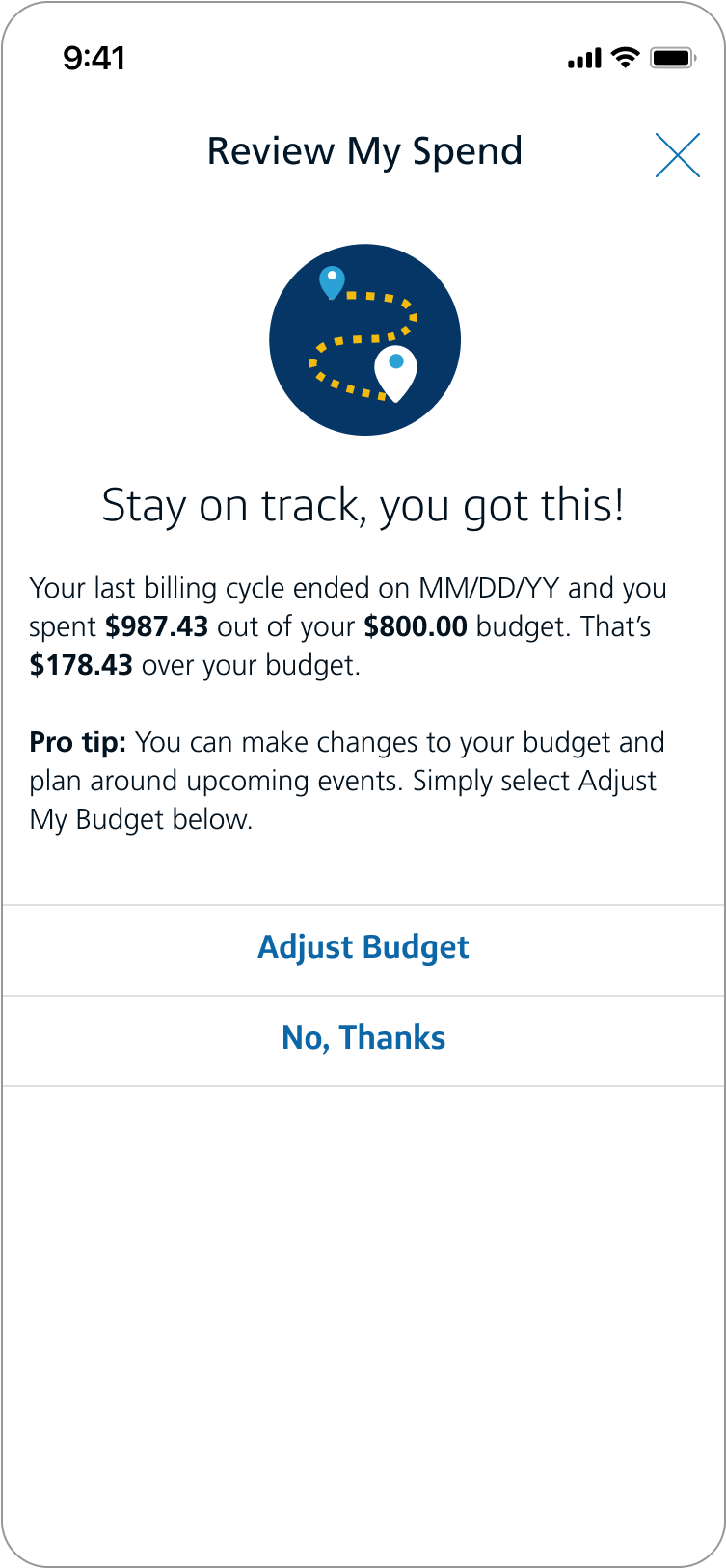

Cycle Reflection

Enabled users to reflect, reset goals, and track progress

Reinforced budgeting as an iterative and learnable behavior

Impact

Beta MVP launched to 10% of customers with the potential to reach 19M+ users

FTUX completion rate increased by ~30%

Spend Tracker users showed strong financial behavior:

Earlier in their Capital One journey

Higher average spend and First-in-Wallet rates

Lower total debt

Reduced account attrition

Higher multi-card ownership

Key Takeaways

Customer behavior improved measurably among users who engaged with Spend Tracker, confirming that the product helped promote better financial habits.

Despite positive engagement, strategic shifts in business priorities led to the product being sunsetted after two years.

The experience delivered valuable insights and reusable design components that influenced future financial well-being products across the company.

Final Thoughts

Redesigning Spend Tracker was a unique opportunity to explore how financial tools can shift daily financial behavior. By grounding the design in user motivation, research insights, and business metrics—we delivered a tool that genuinely helped users gain more control over their monthly spending.

Even though the product was ultimately sunsetted—the learnings from this work continue to inform other initiatives today.